Ways to Give

Stock Donation

Support IFYE with your in-kind gift of appreciated stock.

Giving through your credit card or via check may be easy…but is it your most tax-efficient way to gift?

Put away your checkbook and open up your brokerage account to maximize the impact of your charitable donations. Donating stock offers benefits for both you and IFYE. You can now ask your broker or wealth manager to transfer shares of stock directly from your investment account to IFYE’s brokerage account at Raymond James.

Why Donate Stock to IFYE?

If you own a hefty investment portfolio flush with gains from the past couple of years, a stock donation may help you donate much more efficiently. This is especially true if your income is limited and you were planning to sell off shares to fund your donation.

Here’s why: When you sell shares of stock that have appreciated in value over time, they are subject to capital gains taxes. The amount you owe depends on whether you’ve owned the shares for more than one year or less than one year and also on your total annual income. State income taxes and additional surtaxes can further reduce the net proceeds from the stock sale.

By the time you sell the stock and pay the taxes, you’re losing 25% to 35% of the value. However, if you donate the stock directly to IFYE Association of the USA, Inc. you pay no capital gains tax - and neither does IFYE USA because it is a 501©3 organization. This way, the amount that would have gone to the Internal Revenue Service (IRS) as taxes stays with IFYE to fund future exchange programs.

Here’s the other benefit: You’ll get a tax deduction for the full fair market value of the stock at the time of the transfer. The tax deduction limit for gifting stock to a public charity is up to 30% of your adjusted gross income, though you can carry any excess over for up to five years. Generally speaking the higher your income the greater your tax benefit from the donation of appreciated stock. Please consult with your personal accountant/financial advisor for the precise impact on your taxes.

How to Donate Stock to IFYE

Reach out to your broker or wealth advisor and have them complete the following

Notification of Marketable Stock Transfer Online Form or email them the form below.

Raymond James

224 N Walnut Street

Cameron, MO 644184-1844

Phone: (816) 632-7501

Fax: (816) 632-7403

DTC# 0725

Further Credit to: IFYE Association of the USA

Raymond James account number will be provided later.

The IFYE® Association of the USA, Inc. is a 501(c)(3) non-profit; TIN number: 25-6085638.

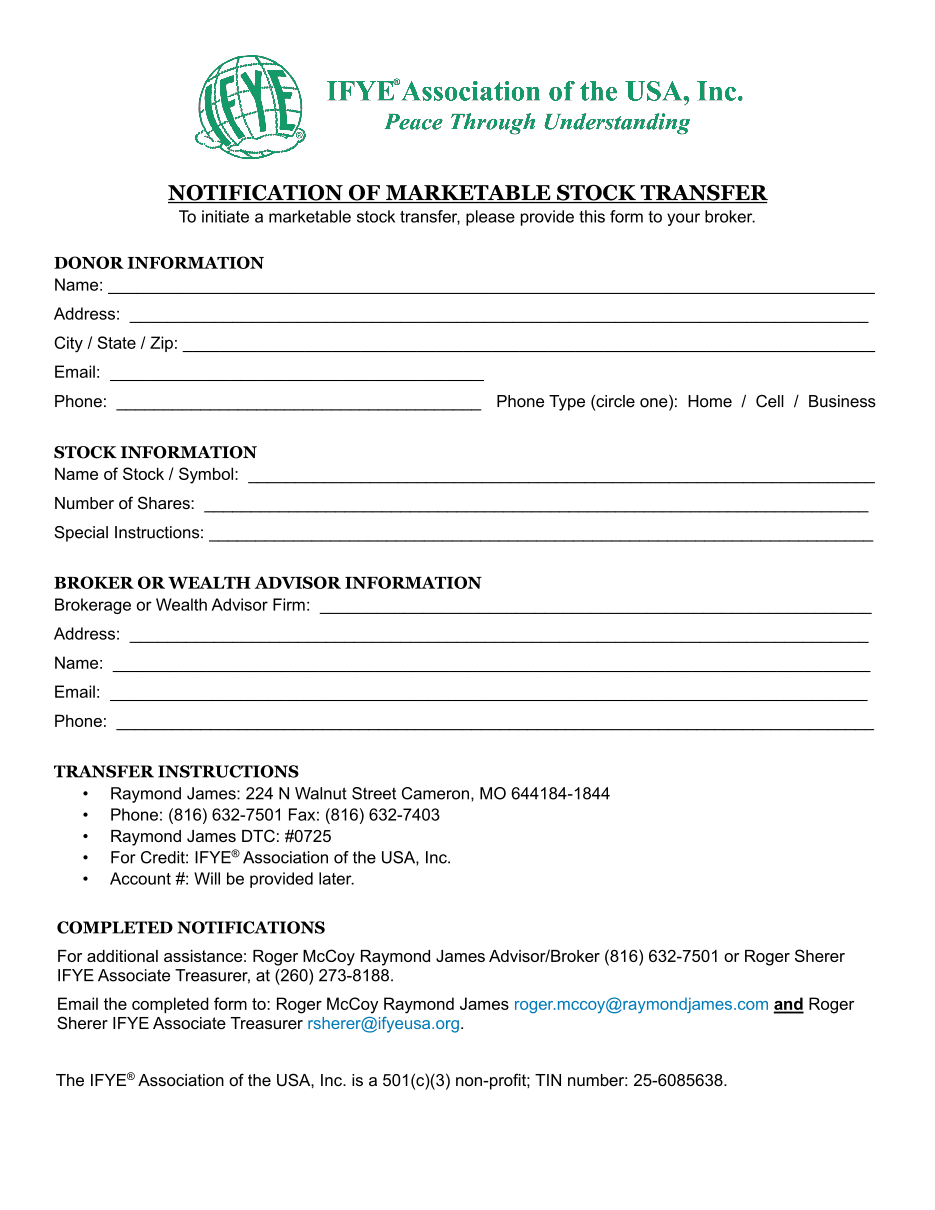

Preview of the Marketable Stock Donation Form

Click the image of the form below to download or print the form.

September 2024